Your Financial Journey, Simplified: Plan, Grow, Prosper

Your financial journey deserves a personal touch. At D’Angelis Wealth Management, we simplify the complexities of wealth planning and help you create a future built on stability, confidence, and peace.

Take the First Step TodayYour Financial Journey, Simplified: Plan, Grow, Prosper

Your financial journey deserves a personal touch. At D’Angelis Wealth Management, we simplify the complexities of wealth planning and help you create a future built on stability, confidence, and peace.

Take the First Step TodayYour Financial Journey, Simplified: Plan, Grow, Prosper

Your financial journey deserves a personal touch. At D’Angelis Wealth Management, we simplify the complexities of wealth planning and help you create a future built on stability, confidence, and peace.

Take the First Step TodayAbout Us

A Legacy of Excellence in Wealth Management

D’Angelis Wealth Management was founded with a singular purpose: to assist our clients in every aspect of their financial lives through personalized service. Our mission is to provide financial stability that leads to lasting independence.

Through our unwavering commitment, we’ve earned a reputation for excellence in the financial industry. For every client, we offer a tailored approach to wealth management—designed to empower your decisions, support your dreams, and navigate life’s most important milestones.

Louis J. D’Angelis, RFC

Vincent D’Angelis, CRPC, RFC

Michael D’Angelis, RFC

Our Impact

Real Stories of Financial Confidence

Who We Serve

Empowering your retirement journey.

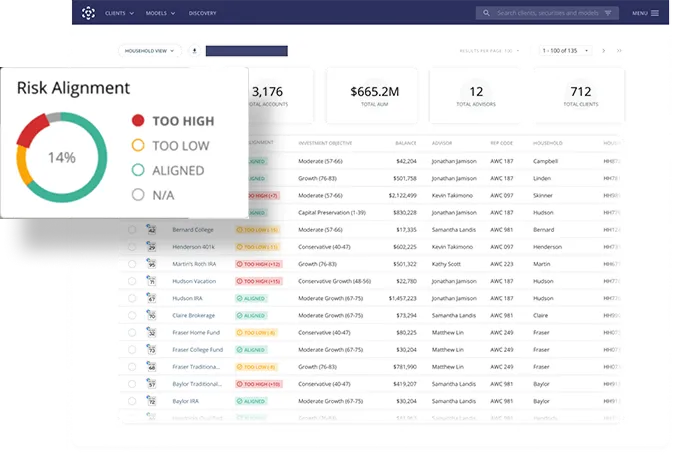

How risky is your portfolio?

Our Services

We follow a simple Step-Investment process and collaborate with our clients.

Fee-Based Personal Financial Planning

We develop custom financial plans that align with your goals and values, guiding you every step of the way with fee-based advice that prioritizes your best interests.

Asset Management

Our disciplined asset management strategies are designed to grow and preserve your wealth. Our team creates and monitors portfolios customized to your risk tolerance, investment objectives, and time horizon.

Retirement Planning

Prepare for the retirement you’ve always envisioned. From understanding income needs to optimizing withdrawal strategies, we help you plan for a stable and fulfilling retirement.

Tax Strategies

Our proactive tax planning strategies aim to reduce your tax burden and increase your savings through tax-efficient practices, helping you keep more of what you earn.

Risk Management Solutions

Safeguarding what you’ve built is essential to your plan, and it’s why we evaluate potential risks and develop insurance strategies to shield your assets.

Education Planning

Give your children or grandchildren the gift of opportunity through education savings plans that align with your financial goals and support their future success.

Long-Term Care

Planning for the unexpected creates stability in your strategy, which is why we provide long-term care solutions to give you confidence as you age.

Estate Planning

Our thoughtful approach to estate planning reduces tax liabilities and streamlines the process for your heirs.

Legacy Planning and Charitable Giving

Leave a lasting impact by incorporating charitable giving and legacy planning into your financial strategy.

Education Planning

Give your children or grandchildren the gift of opportunity through education savings plans that align with your financial goals and support their future success.

Long-Term Care

Planning for the unexpected creates stability in your strategy, which is why we provide long-term care solutions to give you confidence as you age.

Estate Planning

Our thoughtful approach to estate planning reduces tax liabilities and streamlines the process for your heirs.

Legacy Planning and Charitable Giving

Leave a lasting impact by incorporating charitable giving and legacy planning into your financial strategy.

Our Process

Clear Steps to Your Financial Success

No two financial journeys are the same—that’s why our process is designed to focus on you. At D’Angelis Wealth Management, we craft personalized strategies that align with your unique goals and values. Our comprehensive process guides you every step of the way:

Listen & Understand

Plan & Personalize

Implement

Monitor & Adjust

We continuously monitor your progress, review your portfolio, and make adjustments as needed to keep your plan on track with your goals and current market conditions.

Our ultimate goal? To simplify the complex and guide you toward financial clarity and freedom.

Our Financial Advisors

Meet the Team Dedicated to Your Success

Our financial advisors bring 85 years of combined experience, deep knowledge, and a passion for helping clients succeed. At D’Angelis Wealth Management, we don’t just manage wealth—we build relationships founded on trust, integrity, and results.

Each advisor takes a collaborative, hands-on approach to your financial plan, working closely with you to align every strategy with your vision for the future.